Many thanks to @OldRolyBirkinQC for letting me nick the following list (although he doesn’t actually know I’ve done it yet, but he soon will);

Here are some of our millionaire cabinet ministers who just gave themselves a tax cut, while we pay more for being poorer…..which is nice.

Lord Strathclyde worth £10m

Philip Hammond worth £7.5m

George Osborne worth £4.6m

Jeremy Hunt worth £4.5m

David Cameron worth £4m

Dominic Grieve worth £3m

Francis Maude worth £3m

William Hague worth £2.5m

David Laws worth £1m-2m

Nick Clegg worth £1.9m

David Willetts worth £1.9m

Theresa May worth £1.6m

Oliver Letwin worth £1.6m

Owen Paterson worth £1.5m

Kenneth Clarke worth £1m+

Sir George Young £1m+

Iain Duncan Smith worth £1m+

Michael Gove worth £1m+

Grant Schapps is under his other name of Andrew Green.

So, on top of Bedroom Tax, loss of Legal Aid for many, reduction of all kinds of Benefits, the rich just carry on getting richer. David Camoron and George Osborne have, between them, cooked up a scheme to reduce the rate of tax for people on the top rate from 50p in the £ to 45 pence. This does not sound very much, 5 p in the pound but it has been estimated that 13,000 people earning more than £1,000,000 per year will be at least £50,000 per year BETTER OFF.

In times of austerity this does not sound morally or ethically justifiable to me. The poor are going to get poorer, and the rich will get richer by almost £1,000 PER WEEK for doing nothing.

And this is just the beginning;

On April 6, working-age benefits and tax credits will be cut in real terms with the first of three years of maximum 1% rises – well below the present rate of inflation. The poor are beginning to get poorer.

On April 8, disability living allowance begins to be replaced by the personal independence payment (Pip), which charities say will remove support from many in real need. Now the disabled are beginning to get poorer.

From 15 April 2013 a limit will be put on the total amount of benefit that most people aged 16 to 64 can get. This is called a ‘benefit cap’. Local councils will be introducing this between 15 April and 30 September 2013.

From 15 April 2013, the benefit cap will affect people in 4 council areas:

- Bromley

- Croydon

- Enfield

- Haringey

The benefit cap will be introduced in all other council areas between 15 July and and 30 September 2013.

I guess the poor are going to get a bit poorer yet.

What’s included in the Benefit Cap?

The cap will apply to the total amount that the people in your household get from the following benefits:

- Bereavement Allowance

- Carer’s Allowance

- Child Benefit

- Child Tax Credit

- Employment and Support Allowance (unless you get the support component)

- Guardian’s Allowance

- Housing Benefit

- Incapacity Benefit

- Income Support

- Jobseeker’s Allowance

- Maternity Allowance

- Severe Disablement Allowance

- Widowed Parent’s Allowance (or Widowed Mother’s Allowance or Widows Pension you started getting before 9 April 2001)

How much is the benefit cap?

The level of the cap will be:

- £500 a week for couples (with or without children living with them)

- £500 a week for single parents whose children live with them

- £350 a week for single adults who don’t have children, or whose children don’t live with them

Writing in The Daily Telegraph, Mr Osborne and Mr Duncan Smith said: “Our changes will ensure that the welfare state offers the right help to those who need it, and is fair to those who pay for it.” The three-year, real-terms cut was a hard but “necessary” decision to save the taxpayer £2bn a year as part of austerity deficit-reduction measures, they wrote.

37 authorities across Britain revealed 96,041 households faced losing benefit but there were only 3,688 smaller homes available.

Shadow work and pensions secretary Liam Byrne said: “These shocking new figures reveal the big lie behind this Government’s cruel bedroom tax.

“They say it’s not a tax but 96% of people have nowhere to move to. In the same week that millionaires get a huge tax cut, hundreds of thousands of vulnerable people will be hit by a vicious tax they can’t escape.

“This wicked bedroom tax is going to rip neighbour from neighbour, force vulnerable people to food banks and loan sharks, and end up costing Britain more than it saves as tenants are forced to go homeless or move into the expensive private rented sector.”

One of our illustrious banks, RBS, sheepishly announced £5 BILLION of losses at the end of February, but still felt they could afford to pay out nearly £700 MILLION in bonuses. My first question would be “why are they paying bonuses for making a loss?”, and secondly, doesn’t the UK taxpayer own 82% of RBS now? Did we sanction this? Wouldn’t we rather that they repaid what they could to the taxpayer a.s.a.p.?

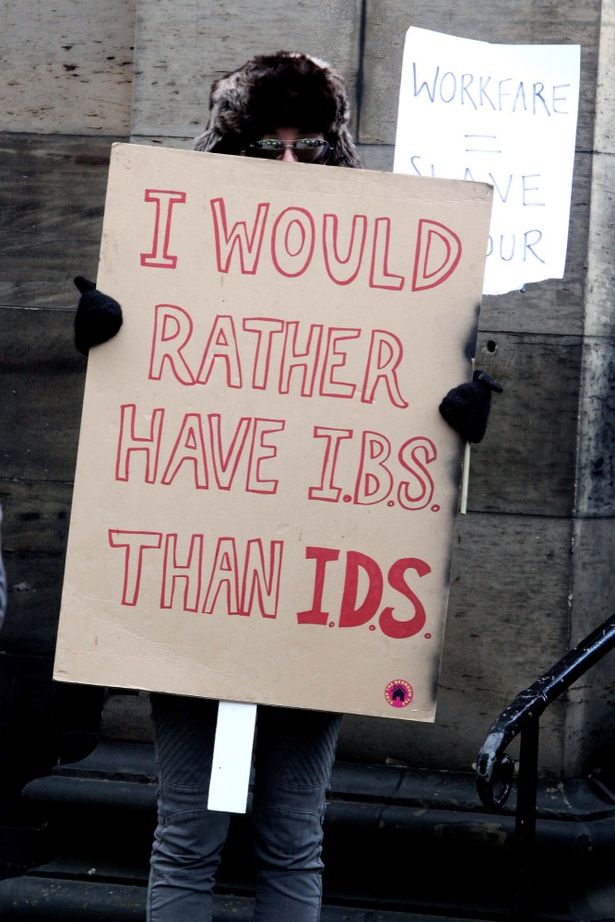

In the meantime Iain Duncan Smith’s claims that he could live on £53 per week if he had to seem to have backfired somewhat. An on-line petition calling for him to put his money where his mouth is attracted 100,000 signatures overnight, and currently stands at 150,000 signatures. Demonstrators gathered to voice their displeasure

And said Mr Duncan Smith was pictured driving a sports car that would cost considerably more than £53 per week to run.

All in this together? My arse.